Dollar-A-Day Insurance in NJ | New Jersey SAIP

A Concise Overview

- – New Jersey’s SAIP program offers cheap auto insurance for low-income drivers

- – The policy rate is a dollar a day or $365 a year

- – In order to qualify, you must also quality for Federal Medicaid with Hospitalization

Dollar-a-day insurance in NJ is available for qualified drivers. NJ SAIP auto insurance is in place for drivers who would not otherwise be able to afford car insurance. Dollar-a-day insurance in NJ requirements include being enrolled in Federal Medicaid with Hospitalization.

Although SAIP car insurance is a great deal monetarily, the auto insurance coverages are very basic and may not be all that you need.

While dollar-a-day insurance might sound great, shopping around for NJ car insurance is the best way to get great coverage at a cheap rate. Enter your ZIP to compare dollar-a-day auto insurance quotes with the SAIP insurance in New Jersey.

What is New Jersey dollar-a-day auto insurance?

According to data from the Insurance Information Institute, around 13 percent of drivers on the roads in the United States don’t have insurance. This means that there are around 32 million drivers on the road each year who have no form of insurance. This represents a major challenge for state governments (since car insurance legislation is set at a state level).

New Jersey created the Special Auto Insurance Policy (SAIP) program to help low-income citizens get insurance on their vehicles.

What is dollar-a-day car insurance?

The dollar-a -day auto insurance rates are just that: a dollar a day or $365 a year. Getting dollar-a-day NJ auto insurance quotes isn’t really necessary, as dollar-a-day-auto insurance rates are the same for everyone. It’s also important to note that there isn’t a dollar-a-day auto insurance company. Coverage is offered through the state.That said, it’s always worth comparing quotes between dollar-a-day NJ and auto insurance company rates on the open market.

Many states have taken different approaches to address what is essentially a multi-faceted and complex problem. In the modern economy, it is hard for many citizens to earn money without access to a car, and yet the cost of insurance is prohibitive for some.

Many get stuck in a Catch-22 situation whereby they cannot earn money without a car and cannot buy insurance until they have a job.

At a time when Americans’ savings rates are at a historic low, many Americans take the option to drive without insurance. This article will consider how New Jersey’s Special Automobile Insurance Policy (SAIP) has gone a long way to providing a practical solution to this problem.

For this reason, if you are purchasing a standard car insurance policy, you definitely want uninsured motorist coverage.

https://youtu.be/LH-6wizPE-g

How do states address the problem of uninsured drivers?

All states are conscious of the problem of uninsured motorists. Effectively, the punishment of those who do not take out insurance does not help the problem – which is that those innocent drivers who are in accidents with uninsured drivers are the ones who have to pay out of pocket for their repairs and rehabilitation.

There is no consensus on how best to address the issue. Ultimately, different states have taken different steps to address the number of uninsured drivers.

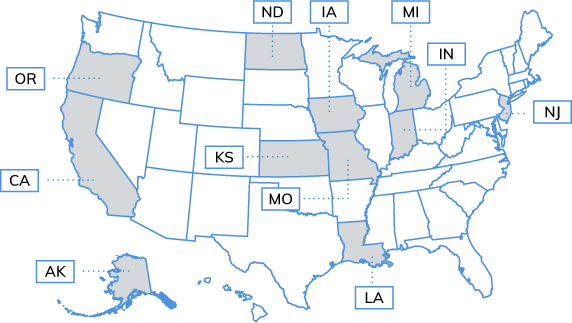

‘No Pay, No Play’

Some states have taken punitive actions by introducing ‘no pay, no play’ laws, which prevent uninsured drivers from being able to receive full compensation in the event of an accident – even if they were not at fault.

The states with this type of legislation are:

- Alaska

- California

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Missouri

- New Jersey

- North Dakota

- Oregon

States with ‘no pay, no play’ laws actually have above average rates of uninsured drivers. If the goal of this policy is to reduce uninsured driving, it seems to have had little impact.

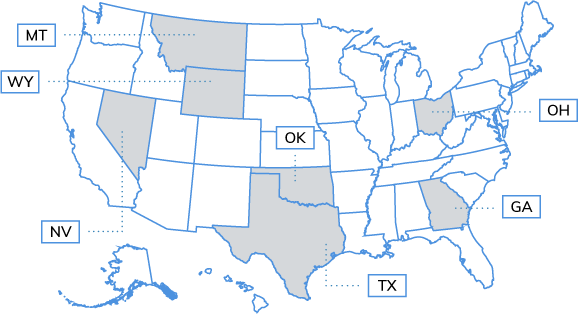

Insurance Verification

In some states, it is the job of an insurance company to inform the state Department of Transport when an insurance policy ends – either because it is canceled or because it lapses.

State law officers can then cross-reference this with the database of motorists in order to catch those who drive without insurance.

States that use this technique are:

- Georgia

- Montana

- Nevada

- Ohio

- Oklahoma

- Texas

- Wyoming

Random Selection

In Ohio, a random selection of drivers each week is selected and are asked to provide proof of insurance. Those who are unable to do so face losing their license as well as other punishments.

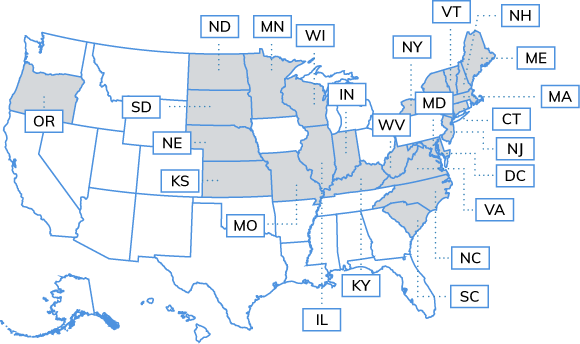

Uninsured Motorist Coverage

Some states have placed the burden of insurance onto the driver, compelling all drivers to have uninsured motorist coverage for those drivers who are at fault without the right coverages.

This means that drivers must take out an Uninsured Motorist Bodily Injury (UMBI) policy – and in the District of Columbia, you are required to get Property Damage (UMPD) in addition.

States that require this are:

- Connecticut

- District of Columbia

- Illinois

- Indiana

- Kansas

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Missouri

- Nebraska

- New Hampshire

- New Jersey

- New York

- North Carolina

- North Dakota

- Oregon

- South Carolina

- South Dakota

- Vermont

- Virginia

- West Virginia

- Wisconsin

While this approach does address the problem of drivers being left out of pocket after a collision with an uninsured (or underinsured) driver, it does not necessarily address the cause of the problem.

Indeed, in cases where insurance is too expensive, it may actually compound the problem because the additional insurance increases the cost, thereby making car insurance more unaffordable.

What is the SAIP?

New Jersey’s approach to uninsured drivers was to effectively lower the barrier to insurance and make an annual insurance policy more affordable.

They, therefore, launched the Special Automobile Insurance Policy (SAIP) initiative to offer a basic car insurance policy for $365 a year.

SAIP is sometimes known as the one dollar a day car insurance policy because of the cost. If you pay in full in advance, however, you can actually get the policy for $360, meaning that it is actually cheaper than a dollar per day.

What is the SAIP?

The NJ SAIP policy helps provide insurance for those who are unable to afford the cost of regular insurance (and therefore likely to be tempted to forego insurance entirely). Affordable dollar-a-day auto insurance in NJ is available in Newark, Vineland, Camden, and all other New Jersey cities.

For those with limited financial resources, the SAIP is offered through the state government and allows individuals to receive limited coverage for an entire year at the cost of either $365 if paid in two annual installments, or $360 if paid in full at the outset of the coverage.

Who is eligible for the SAIP?

How do you get dollar-a-day insurance/SAIP?

Eligibility for the SAIP is contingent upon being fully enrolled in Federal Medicaid with Hospitalization. This is simply the criteria the State of New Jersey uses to gauge need, and the insurance is in no way connected with Medicaid, nor is it reliant on any particular health criteria.

It is important to also note that not all those who receive Medicaid are eligible for SAIP. If you are in doubt, you should speak to an insurance broker about whether you qualify. They will most likely be able to determine your eligibility from the number of your Medicaid ID card.

If you do not qualify for Medicaid, then you will not qualify for SAIP. You also need to be a resident of New Jersey in order to access the SAIP (your Medicaid and Driving License may need to be updated to prove residency).

If you lose your Medicaid benefits, you can continue on the SAIP until your renewal after a year (i.e. cancellation of Medicaid does not mean cancellation of health insurance). If you share a home with many people, they will all be covered by the SAIP, providing that they only drive one car. If you have a multi-car home, then only one designated vehicle will be covered by the SAIP.

You will also not be eligible if your driver’s license is currently suspended or has been revoked as a result of a violation or series of violations. You need to actively demonstrate a license in order to receive SAIP. However, if you just have accidents or speeding tickets but still have a valid license, you can receive SAIP. If you have had your driving license revoked or suspended in the past you will be eligible for SAIP once it becomes active again.

SAIP does not take into account your driving history as it is designed to be accessible for all and provides an option for those who may struggle to get insurance elsewhere (i.e. those who are liable to be driving without insurance).

In all circumstances, it is best to speak with a broker before making any decisions. They will be able to guide you through the process and the specifics of your situation in the most cost-efficient way.

What does SAIP cover?

SAIP provides emergency treatment in the aftermath of an accident, including brain and spinal cord injuries up to a value of $250,000. It will also provide a ‘death benefit’ of $10,000 if there is a fatality in any car accident.

This represents a significant coverage, although only in certain circumstances, and there are some caveats when it comes to fault in the accident. However, this is equivalent to a basic car insurance policy in most states in that it prevents you from experiencing catastrophic financial burdens as a result of something that takes place while you are driving.

What does SAIP not cover?

As mentioned above, the SAIP is designed to cover only emergencies and is relatively limited in its scope.

For example, it doesn’t cover outpatient treatments (although much of this will be covered under your existing Medicaid policy) or other non-essential medical care. It also does not cover any damage you may have caused to someone else’s property (including their vehicle) as well as property damage to your own car.

SAIP only covers emergency medical expenses, and very little else. However, in the event of a collision, the cost of the medical bills is likely to be the biggest expense faced.

How do you apply for the SAIP?

How do you apply for the SAIP/dollar-a-day insurance?

To get SAIP you will need to speak to your insurance broker, as most insurance agencies will be able to offer the plan. You can also speak to the Personal Insurance Plan (PAIP) provider hotline at the dollar-a-day NJ phone number: 1-800-652-2471 (number correct as of September 2020) to buy dollar-a-day auto insurance.

To apply, you will need to provide all driving licenses for those who will operate the vehicle, as well as the vehicle’s registration, and your Medicaid insurance card.

To confirm all information is correct before you apply, check the State of New Jersey SAIP website, as requirements may change in the future. An insurance broker will be able to walk you through all steps of the process and determine your eligibility.

It is important to note that there are no fees for applying for the SAIP. This is a crucial part of the policy since it ensures that there are no add-ons or hidden charges. If your insurance broker attempts to charge you a fee, you should consider searching elsewhere. Use the State of New Jersey website (link above) to help you find a new broker who can help you apply for the SAIP without any fees.

SAIP is a relatively unique solution to the problem of uninsured drivers. By effectively rebranding the problem as a societal one, rather than an individual one, the State of New Jersey has created a collective solution to the problem.

In the same way that drivers pay tax to ensure that the roads are adequately paved, marked, and lit, the government is also providing a service to ensure that more drivers are insured. Since every driver is potentially at the mercy of an uninsured driver, this is a solution that benefits everyone.

The ability to access insurance for as little as $360 a year (or $365 if paying in two installments) makes the cost of getting adequately insured a far less prohibitive situation for drivers. Although the insurance is not comprehensive coverage, it is enough to provide a ‘safety net’ for drivers who may otherwise have been tempted to drive without insurance.

Ultimately, in the case of an accident with an uninsured driver, it is the insured driver who has to subsidize the uninsured driver, often to the tune of thousands of dollars. The New Jersey SAIP effectively spreads this cost across all taxpayers and one in which all drivers – whether insured or previously uninsured – pay less out of pocket for insurance.

What are other ways to save on auto insurance?

Those who don’t qualify for dollar-a-day insurance might feel that they are out of options. However, many auto insurance companies offer discounts and other options to save money. It is important to make sure, no matter which insurance products you go with, that it meets the minimum coverage requirements in New Jersey, which can be seen in the chart below.

Minimum Auto Insurance Coverage Requirements in New Jersey

| Requirement | Standard Policy | Basic Policy |

|---|---|---|

| Personal Injury Liability | $15,000 per person/$30,000 per accident | Optional coverage of $10,000/accident |

| Property Damage Liability | $5,000 per accident | $5,000 per accident |

| Personal Injury Protection (PIP) | $15,000 per accident Up to $250,000 for specific injuries | $15,000 per person/$30,000 per accident Up to $250,000 for specific injuries |

If you don’t have at least the minimum car insurance required in NJ, you can face stiff penalties.

How does New Jersey dollar-a-day auto insurance compare to other auto insurance policies?

It’s always best to compare your options, and the NJ SAIP plan may not be the best car insurance in NJ for your needs. See what else is available before you buy.

Even if you don’t qualify for dollar-a-day auto insurance rates in NJ, compare car insurance quotes for the cheapest coverage. Before you buy dollar-a-day insurance in NJ, enter your ZIP to get free auto insurance insurance quotes to compare with the SAIP. You could get better coverage at an affordable rate.