Buy Cheap Houston, Texas Auto Insurance in 2025

If you want to find cheap car insurance in Houston, check out this guide. You can find the best car insurance rates in Houston depending on factors like age, credit score, ZIP code, and driving history.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Aug 26, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our auto insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different auto insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Houston, Texas Summary | Houston Statistics |

|---|---|

| City Population | 2,312,717 |

| City Density | 3,991 People per Square Mile |

| Average Cost of Car Insurance in Houston | $6,255 |

| Cheapest Car Insurance Company | USAA |

| Road/Pavement Conditions | Poor Share – 24% Mediocre Share – 28% Fair Share – 11% Good Share – 38% Vehicle Operating Costs – $610 |

Houston, Texas, is one of the most popular and largest cities in Texas with over 2.3 million residents.

Interesting fact: Houston is close to six bodies of water — Sheldon Lake, Lake Houston, Bear Lake, the San Jacinto River, Buffalo Bayou, and Burnet Bay.

But you didn’t come to this guide to learn about the bodies of water. You came to find the best car insurance that the city has to offer.

As you noticed in our introductory table, the average cost of car insurance in Houston is $6,255 per year. That’s approximately $521 per month. These numbers are what the average policyholder pays for car insurance in Houston.

So what do premiums look like from different car insurance providers? This guide will explore all those details.

Read More: Buy Cheap Texas Auto Insurance

We’ll cover the cost of car insurance in Houston, what it’s like to drive in Houston, car insurance options for military and veterans, specific laws in Houston, and a review of frequently asked questions to wrap up the guide.

If you want to get right to the quotes, enter your ZIP code into our free online quote comparison tool. For a comprehensive view on car insurance in Houston, continue through the guide.

What is the cost of car insurance in Houston?

If you’re a new resident of Houston, you’ll notice that car insurance in the city is more expensive than most cities in the state or even the nation. It’s a chore to find cheap car insurance in Houston.

You might find yourself asking how does my Houston, TX stack up against other top metro average rates? We’ve got your answer below.

This section will guide you through how you can find cheap car insurance without the challenge of searching for hours on the internet on which company has the cheapest rates.

The cost of car insurance is determined by several factors, which are age, gender, marital status, ZIP code, commute mileage, coverage level, credit history, and driving record.

Other factors such as education and occupation are also considered when a potential customer is pursuing a policy with a car insurance provider (another name for car insurance company or insurer).

When these factors are used to determine car insurance, they can be cheaper or more expensive than the average annual premium. Continue through this section to find out which factors give Houston residents cheaper or more expensive car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does gender and age affect my car insurance in Houston?

Texas is one of the states that still determine car insurance premiums (often referred to as car insurance rates as well) based on age, gender, and marital status. But why?

Car insurance experts lean on statistics that show that younger, male drivers take more risks when operating a motor vehicle.

These states no longer using gender to calculate your auto average rates in Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania. But age is still a significant factor because young drivers are often considered high-risk. Texas does use gender, so check out the average rates by age and gender in Houston, TX.

Therefore, younger male drivers will more than likely have a more expensive car insurance premium per year. This can be problematic for parents of teen drivers. Let’s see how expensive car insurance premiums are based on age, gender, and marital status in Houston.

The compilation of data provided below shows car insurance by age, gender, and marital status in three separate tables. It is based on the averages paid from policyholders in the city and not based on averages directly from insurers.

| Houston Policyholder Age | Houston Annual Premium |

|---|---|

| 17-Year-Old Driver | $9,393 |

| 25-Year-Old Driver | $3,795 |

| 35-Year-Old Driver | $3,019 |

| 60-Year-Old Driver | $2,876 |

Seventeen-year-old drivers have the most expensive policies in Houston, and the premium is more expensive than Houston’s average annual premium of $6,255.

Drivers in Houston who are older than 17 but younger than 25 may pay something close to that premium. By the time a policyholder is 25 years old, they’ll pay significantly less for car insurance, as seen in the table. All other drivers pay at least $2,500 less for car insurance premiums in Houston.

Houston, TX auto insurance rates by company and age is an essential comparison because the top auto insurance company for one age group may not be the best company for another age group.

What about the cost of insurance based on gender? We can review that answer in this data summary.

| Houston Policyholder's Gender | Houston Annual Premium |

|---|---|

| Male | $4,771 |

| Female | $4,501 |

Male policyholders pay over $200 more for car insurance than female drivers. Later on in the guide, we’ll revisit how gender is affected by car insurance by exploring the wages and car insurance as a percent of income.

The last table in the section is a composite of all three factors. Do they increase premiums or make them cheaper?

| Age, Gender, and Marital Status | Houston Annual Premium |

|---|---|

| Single 17-Year-Old Male | $10,227 |

| Single 17-Year-Old Female | $8,560 |

| Single 25-Year-Old Male | $3,906 |

| Single 25-Year-Old Female | $3,683 |

| Married 35-Year-Old Male | $3,068 |

| Married 35-Year-Old Female | $2,970 |

| Married 60-Year-Old Male | $2,961 |

| Married 60-Year-Old Female | $2,791 |

Once again, teen drivers have the most expensive policies, while 60-year-old drivers have the lowest car insurance premiums. Single and younger drivers have more expensive policies. As you find quotes from car insurance companies, there could be a few discounts that decrease the annual premium, so don’t let the average premiums get you down.

What are the cheapest ZIP codes in Houston?

There are 104 ZIP codes in Houston. All of them have different average annual premiums. How come?

Check out the monthly Houston, TX auto insurance rates by ZIP Code below:

ZIP codes are identifiers for areas around the city. Some of the areas in Houston are prone to risk. So car insurance providers and analysts say it would cost more to insure a person who lives in that particular ZIP code.

Unfortunately, some of the ZIP code areas with a more expensive premium are highly populated urban areas or low-income areas. Both areas, based on statistics, are more likely to encounter risk. The table presented in this section will explore the most expensive and cheapest ZIP codes in Houston.

| Houston ZIP Codes | Houston Average Annual Premium |

|---|---|

| 77059 | $6,255 |

| 77062 | $6,264 |

| 77058 | $6,308 |

| 77339 | $6,352 |

| 77079 | $6,442 |

| 77005 | $6,459 |

| 77094 | $6,513 |

| 77598 | $6,524 |

| 77336 | $6,539 |

| 77006 | $6,550 |

| 77098 | $6,594 |

| 77069 | $6,609 |

| 77046 | $6,623 |

| 77070 | $6,655 |

| 77025 | $6,664 |

| 77089 | $6,714 |

| 77007 | $6,725 |

| 77027 | $6,741 |

| 77056 | $6,743 |

| 77030 | $6,752 |

| 77024 | $6,767 |

| 77018 | $6,788 |

| 77489 | $6,794 |

| 77064 | $6,796 |

| 77068 | $6,797 |

| 77096 | $6,825 |

| 77095 | $6,825 |

| 77043 | $6,825 |

| 77015 | $6,844 |

| 77054 | $6,844 |

| 77338 | $6,847 |

| 77077 | $6,853 |

| 77019 | $6,857 |

| 77049 | $6,873 |

| 77008 | $6,882 |

| 77009 | $6,915 |

| 77055 | $6,932 |

| 77031 | $6,940 |

| 77080 | $6,946 |

| 77092 | $6,950 |

| 77063 | $6,965 |

| 77034 | $6,970 |

| 77041 | $6,971 |

| 77002 | $6,995 |

| 77057 | $7,043 |

| 77065 | $7,044 |

| 77029 | $7,052 |

| 77035 | $7,054 |

| 77085 | $7,103 |

| 77084 | $7,112 |

| 77042 | $7,117 |

| 77021 | $7,150 |

| 77075 | $7,189 |

| 77044 | $7,215 |

| 77010 | $7,224 |

| 77082 | $7,227 |

| 77013 | $7,229 |

| 77032 | $7,242 |

| 77066 | $7,257 |

| 77011 | $7,286 |

| 77003 | $7,313 |

| 77071 | $7,325 |

| 77073 | $7,328 |

| 77087 | $7,330 |

| 77074 | $7,337 |

| 77040 | $7,346 |

| 77012 | $7,348 |

| 77047 | $7,389 |

| 77023 | $7,399 |

| 77014 | $7,409 |

| 77045 | $7,420 |

| 77017 | $7,427 |

| 77090 | $7,441 |

| 77086 | $7,472 |

| 77061 | $7,479 |

| 77048 | $7,487 |

| 77051 | $7,489 |

| 77201 | $7,492 |

| 77204 | $7,496 |

| 77004 | $7,497 |

| 77050 | $7,505 |

| 77020 | $7,515 |

| 77026 | $7,554 |

| 77038 | $7,567 |

| 77028 | $7,580 |

| 77093 | $7,593 |

| 77099 | $7,600 |

| 77039 | $7,602 |

| 77022 | $7,606 |

| 77081 | $7,610 |

| 77088 | $7,612 |

| 77067 | $7,613 |

| 77016 | $7,629 |

| 77091 | $7,644 |

| 77060 | $7,665 |

| 77037 | $7,670 |

| 77083 | $7,671 |

| 77076 | $7,685 |

| 77078 | $7,701 |

| 77053 | $7,748 |

| 77033 | $7,841 |

| 77072 | $7,909 |

| 77036 | $8,151 |

The cheapest ZIP code in Houston is 77059. This ZIP code is a small area known as Pine Brook, which is west of the Armand Bayou and northwest of a small town known as Brookwood. It’s a suburban area west of the Prairie Wetlands.

The most expensive ZIP code in Houston is 77036, which is a triangular area that encompasses smaller towns such as Chinatown and Sharpstown. These urban communities are located southwest of Midtown in Houston. It’s heavily populated with a diverse array of ethnicities and cultures.

What’s the best car insurance company in Houston?

As informers of car insurance and other general information, we won’t decide which car insurance is best. What we can provide is an overview of car insurance premiums, facts about how car insurance is determined, factors that determine car insurance, and other facts that can help you find the car insurance provider that’s best for you.

Which Houston, TX auto insurance company has the cheapest rates? And how do those rates compare against the average Texas auto insurance company rates? We’ve got the answers below.

The best car insurance company is the company that can meet your needs as far as budget and coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the cheapest car insurance rates by company?

Although we’ll leave it to you to determine which car insurance company best for you, we still can give you a summary of car insurance company premiums based on our in-house data.

What we’ve found are several averages that policyholders pay each year for car insurance. Listed below is the average annual premium for each major company in Houston. Let’s see how the company average compares to Houston’s average annual premium for car insurance.

| Company | Average Annual Premiums | Compared to Houston Average ($6,255) | Percent Difference |

|---|---|---|---|

| Allstate | $6,515 | +$260 | +3.99% |

| American Family | $6,847 | +$592 | +8.65% |

| Geico | $3,969 | -$2,286 | -57.60% |

| Nationwide | $4,410 | -$1,845 | -41.84% |

| Progressive | $5,257 | -$998 | -18.98% |

| State Farm | $3,466 | -$2,789 | -80.47% |

| USAA | $2,932 | -$3,323 | -113.34% |

For this data table, we wanted to show you the average annual cost of car insurance per company. The cheapest car insurance company is USAA. However, USAA isn’t available to everyone — only to military personnel, active and retired, and their immediate families. The second cheapest company is State Farm, with an average annual premium of $3,466.

When we compared the average premiums of each company to Houston’s car insurance average, there’s a major difference in cost. The third column entitled “Compared to Houston average” is where the company average premium was subtracted from the Houston average.

Car insurance premiums that were more expensive have a plus sign (+) next to their value, but car insurance premiums that were cheaper than Houston’s average have a negative sign (-) next to their value.

The “Percent Difference” column is the difference between the company and city average that’s divided into the company’s annual premium.

What are the best car insurance for commute rates?

During the quote process, car insurance companies will ask what your vehicle will be used for. If you drive your vehicle for work commutes, school commutes, or commuting in general, then it’s likely that you’ll pay more expensive car insurance premiums. On average, a Texas motorist drives about 15,500 miles within a year.

Let’s see the annual premiums from car insurance providers based on commute mileage.

| Company | 10-Mile Commute. 6,000 Annual Mileage. | 25-Mile Commute. 12,000 Annual Mileage. |

|---|---|---|

| Allstate | $6,354 | $6,676 |

| American Family | $6,847 | $6,847 |

| Geico | $3,895 | $4,043 |

| Nationwide | $4,410 | $4,410 |

| Progressive | $5,257 | $5,257 |

| State Farm | $3,466 | $3,466 |

| USAA | $2,894 | $2,969 |

American Family, Nationwide, Progressive, and State Farm issue the same car insurance premium prices regardless of the commuting mileage you’re estimated to drive within the year of the policy. Allstate, Geico, and USAA will likely issue higher car insurance premiums based on the mileage you drive during the policy. The two cheapest companies based on commute mileage are State Farm and USAA.

What are the best car insurance for coverage level rates?

The coverage level is based on the state’s minimum requirement for car insurance, which is liability coverage. Within liability coverage is something called a coverage rule.

Coverage rules list the coverage limits of the liability coverage policy.

Your coverage level will play a major role in your Houston auto insurance rates. Find the cheapest Houston, TX auto insurance rates by coverage level below:

Coverage limits are the amount of money car insurance companies will use to cover any bodily injury expenses and property damages that occur after a car accident.

Texas law says that each motorist must have liability coverage that consists of $30,000 for bodily injury of one person per accident, $60,000 for bodily injury of multiple people per accident, and $25,000 for property damage per accident. Many car insurance companies will identify the Texas minimum requirement as the 30/60/25 rule.

Since Houston is in Texas, it’s in total compliance with state law. But if a motorist in Houston feels like the coverage limits aren’t enough to cover an accident, they can ask a car insurance provider if they can have a higher coverage level. Higher coverage levels come with a higher cover limit and more expensive annual premiums.

| Group | Low | Medium | High |

|---|---|---|---|

| Allstate | $6,345 | $6,451 | $6,748 |

| American Family | $6,296 | $6,550 | $7,694 |

| Geico | $3,723 | $3,909 | $4,276 |

| Nationwide | $4,739 | $4,220 | $4,270 |

| Progressive | $5,010 | $5,235 | $5,527 |

| State Farm | $3,269 | $3,453 | $3,676 |

| USAA | $2,814 | $2,918 | $3,063 |

As shown in the table, car insurance companies charge policyholders less for lower levels of coverage. Medium and high coverage are more expensive per year, but the coverage limit gives a policyholder more coverage just in case the accident costs exceed the minimum coverage amount.

Medium coverage levels are often associated with 50/100/50 coverage rules, while high coverage levels are associated with 100/300/100 coverage rules.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the best car insurance for credit history rates?

Car insurance companies will look at your credit history when you want to pursue a policy. Why? Car insurance companies want to know if you have the financial ability to pay their premiums.

Your credit score will play a major role in your Houston auto insurance rates unless you live in these states where discrimination based on credit is not allowed: California, Hawaii, Massachusetts, and North Carolina. Find the cheapest Houston, TX auto insurance rates by credit score below.

They’ll also look into your insurance history as well, which is often called an insurance credit history. Credit experts and insurance companies say there’s a correlation between credit history and risk.

Your credit score is not affected when a car insurance provider checks your credit. Your credit history will affect how much you’ll pay for car insurance. Let’s take a look at how much a Houston policyholder will pay based on the premiums from major companies.

| Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $7,156 | $5,248 | $4,497 |

| American Family | $7,258 | $4,602 | $4,047 |

| Geico | $5,667 | $3,197 | $2,123 |

| Nationwide | $4,493 | $3,610 | $3,137 |

| Progressive | $5,229 | $4,519 | $4,188 |

| State Farm | $4,516 | $2,820 | $2,252 |

| USAA | $3,854 | $2,254 | $1,822 |

Policyholders with poor credit have the most expensive car insurance premiums due to the correlation to risk. Houston policyholders with fair and good credit have premiums that are much less than the city’s average. Geico, State Farm, and USAA have the cheapest premiums based on good credit.

What are the best car insurance companies for driving record rates?

One of the most important factors of car insurance is your driving record. A driving record is one of the factors that you can control. The better driver you are, the cheaper your car insurance premiums will be. Car insurance providers will issue discounts to policyholders who have a clean driving record.

Your driving record will play a major role in your Houston auto insurance rates. One of the offenses that will cause the biggest rate increases is drunk driving, which happens all too often in Texas.

Our study on the worst states for drunk driving found Texas to be the 4th-worst for traffic deaths with alcohol to blame. Houston, out of all the major Texas cities, struggles the most with this issue.

Read more: 10 Worst Cities for Drunk Driving

Because of that, there are harsh penalties for DUIs in Houston and Texas. A Houston, TX DUI may increase your auto insurance rates 40 to 50 percent. Check out the graph below that shows different auto insurance rates in Houston by driving record infraction.

The data provided in this section will show the premiums based on a Houston motorist’s driving record.

| Company | Clean record | With one speeding violation | With one accident | With one DUI |

|---|---|---|---|---|

| Allstate | $5,027 | $5,027 | $7,838 | $8,168 |

| American Family | $6,204 | $6,204 | $7,998 | $6,980 |

| Geico | $3,361 | $4,339 | $4,481 | $3,696 |

| Nationwide | $3,820 | $4,320 | $3,820 | $5,679 |

| Progressive | $4,576 | $5,160 | $5,936 | $5,357 |

| State Farm | $3,071 | $3,071 | $3,534 | $4,188 |

| USAA | $2,175 | $2,499 | $3,239 | $3,814 |

Accidents and DUIs have premiums that are much more expensive than the Houston average for car insurance. The companies with lower-than-city-average rates under accidents and DUIs are Geico, Nationwide, Progressive, State Farm, and USAA. Allstate and American Family increase their premiums dramatically if one accident or DUI conviction is on a policyholder’s driving record.

To help with your driving skills and potentially your car insurance rates, consider taking a driving safety course.

What are some car insurance factors in Houston?

Another question car insurance companies will ask during the quote process is your level of education and your occupation. College students can be eligible for discounts if they happen to be under their parents’ or legal guardian’s policy.

Factors affecting auto insurance rates in Houston, TX may include your commute, coverage level, tickets, DUIs, and credit. Controlling these factors will help you maintain cheap Houston, Texas auto insurance.

Speaking of discounts, those who have higher education levels are correlated with taking fewer risks on the roadways.

Occupation, on the other hand, is another way to look at the financial ability of a potential customer or policyholder. Car insurance companies have a database of occupations and their average annual wages. This allows them to estimate whether someone can afford their policies.

This section will explain why these factors are important and show how they affect Houston residents and car insurance policyholders.

Metro Report – Growth and Prosperity

First, we’ll examine the Metro Monitor from the Brookings Institute.

The Brookings Institute is a nonprofit organization that’s dedicated to research that leads to innovative ideas that will help create solutions to problems in society at the local, national, and global level.

The Metro Monitor is the projection of job growth and prosperity in a metro area. Performance is measured from one to 100, where one through 20 is the best performance, and 81 through 100 is the worst performance.

Houston is part of a larger metro area known as Houston-The Woodlands-Sugar Land, Texas. Let’s look at a summarized metro monitor as it relates to job growth and prosperity.

| Rating | % Change one Year | Growth one-Year Rating | % Change 10 Years | Growth 10-Year Rating |

|---|---|---|---|---|

| Overall Rating | - | 85 out of 100 | - | 9 out of 100 |

| % Change in Jobs | 0.90% | 71 out of 100 | 16.60% | 13 out of 100 |

| % Change in GMP | 0.40% | 91 out of 100 | 19.40% | 22 out of 100 |

| % Change in Jobs in Young Firms | 0.80% | 76 out of 100 | 3.60% | 8 out of 100 |

The latest projects were published in 2019, and it shows the larger metro area job growth performing well in the past decade. However, 2016 and 2017 were not good years for job growth. Overall, though, it appears job growth in Houston-The Woodlands-Sugar Land performed well.

GMP stands for Gross Metropolitan Product. GMP is the value of goods and services produced within a metropolitan area, like Houston-The Woodlands-Sugar Land, during a specific period.

In this case that would be the span of 2016 to 2017 and 2007 through 2017. Based on the Metro Monitor results, it appears the metro area had performed well.

And the job growth for young firms and start-up companies in the Houston-The Woodlands-Sugar Land area performed well, also.

With the overall good performance of job growth, what was prosperity like for the Houston-The Woodlands-Sugar Land metro area? Let’s review the prosperity projections in the table below.

| Rating | % Change one Year | Prosperity one-Year Rating | % Change 10 Years | Prosperity 10-Year Rating |

|---|---|---|---|---|

| Overall Rating | - | 95 out of 100 | - | 74 out of 100 |

| % Change in Productivity | -0.40% | 86 out of 100 | 2.40% | 74 out of 100 |

| % Change in Standard of Living | -0.90% | 96 out of 100 | -4.00% | 78 out of 100 |

| % Change in Average Annual Wage | -0.40% | 98 out of 100 | 4.60% | 55 out of 100 |

Although there wasn’t a major percent change in prosperity from 2016 to 2017, the projections from 2016 to 2017 show that the Houston-The Woodlands-Sugar Land metro area performed poorly in productivity, the standard of living, and average annual wage. When measured in the past decade, the metro area performed moderately poorly overall.

Median Household Income

To determine the household incomes of Houston, we’ll use Data USA’s research for this section. What is the median household income?

Median household income is the income level earned by designated households where half of the homes in the area, such as Houston, earn more and half earn less.

Therefore, the median household incomes are incomes of households who are in the halfway margin or middle margin of earned incomes. Median household income is likely used by Data USA because it gives an accurate analysis of an area’s economic status.

Median household incomes are frequently used to determine housing affordability, and appear to be more reliable than average annual income (also called mean household income).

The latest report on median household income in Houston is $51,203, which is a 2018 projection. Houston’s median household income is $10,734 less than the national median household income.

What does this have to do with car insurance? Car insurance premiums are an essential part of the cost of living in a city like Houston. Most people in the city use a motor vehicle to get around.

When we consider any sort of annual income, you may want to know how much car insurance affects your income. To determine this we divide the city’s average premium for car insurance into annual income. This will show car insurance as a percent of income.

For example, let’s divide Houston’s average for car insurance into Houston’s median household income, which will look like this: (6,255 / 51,203). When put into a calculator, there will be a decimal answer of 0.12216. This number, in percent, is 12.22 percent. Therefore, the median household income will pay 12.22 percent of their income for car insurance.

You can try it for yourself. Enter your estimated annual income and an annual premium in the Calculator Pro tool below. It will do the math for you and give you the percent car insurance will take from your income for the year.

CalculatorPro

Homeownership in Houston

How is homeownership related to car insurance? Most car insurance companies offer discounts to homeowners when they bundle their car insurance with their home insurance.

Major car insurance companies have several departments where policyholders can insure property such as homes, boats, motorcycles, and even condos.

In Houston, about 42 percent of housing units are occupied by the homeowner. Houston’s homeownership percentage is 22 percent lower than the national average, which is roughly 64 percent.

Renting is cheaper in the short term. However, owning a home can save money in the long term. Car insurance providers offer renters insurance and often give discounts to renters when they bundle it with car insurance.

Education in Houston

The female student population outnumbers the male student population in Houston. Data USA reported that about 92,000 female students attended colleges or universities while the male student population was roughly 73,000. Over 37,000 degrees were awarded to college and university students in 2017.

Data USA reviewed the graduation percentage by ethnicity and found that most students who graduate from colleges and universities in Houston are Hispanic or Latino. White students have the second-largest percentage while black or African-American students have the third-largest percentage.

In 2017, the University of Houston awarded over 9,400 degrees, and its downtown Houston branch awarded over 3,500. Houston Community College awarded 7,514 degrees.

The most popular majors in Houston are general studies, general business administration and management, and medical assistant programs.

The most well-known major may be medical research and health care. The Texas Medical Center is known around the globe for its health care and research.

Tuition costs for private four-year colleges are roughly $30,000, while public four-year colleges are $6,940 for in-state students and $21,000 for out-of-state students.

College students who are policyholders can receive discounts to curve higher-than-average premiums from car insurance companies. Since most students are under 25, a discount will give a student an advantage over challenging finances. Or college students can remain under their parent or legal guardian’s policy to save money on car insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Is there a difference in wage by race and ethnicity in common jobs?

Are there wage disparities among ethnic groups in Houston? By reviewing the wage disparities in Houston, we’re able to see how much each ethnic group spends on car insurance as a percent of income. Data USA reported average, full-time annual salaries of common jobs in Houston in 2018.

We’ve included car insurance as a percent of income to show how Houston’s average annual premium affects full-time salaries in common jobs. This comparison shows how affordable car insurance can be.

| Wage by Race and Ethnicity in Common Jobs | Other Managers | Car Insurance as % of Income (Managers) | Elementary and Middle School Teachers | Car Insurance as % of Income (Teachers) | Retail Salesperson | Car Insurance as % of Income (Retail) | Drivers/Sales Workers and Truck Drivers | Car Insurance as % of Income (Drivers) | Cashiers | Car Insurance as % of Income (Cashiers) |

|---|---|---|---|---|---|---|---|---|---|---|

| American Indian | $80,546 | 7.77% | $44,269 | 14.13% | $17,924 | 34.90% | $74,078 | 8.44% | $13,225 | 47.30% |

| Asian | $114,787 | 5.45% | $32,706 | 19.12% | $28,382 | 22.04% | $31,938 | 19.58% | $22,270 | 28.09% |

| Black | $73,953 | 8.46% | $44,964 | 13.91% | $28,532 | 21.92% | $50,839 | 12.30% | $13,658 | 45.80% |

| Other | $60,179 | 10.39% | $40,606 | 15.40% | $24,005 | 26.06% | $46,089 | 13.57% | $14,223 | 43.98% |

| Other Native American | - | - | - | - | $38,185 | 16.38% | $55,161 | 11.34% | $12,941 | 48.33% |

| Two or More Races | $82,011 | 7.63% | $45,454 | 13.76% | $27,758 | 22.53% | $37,410 | 16.72% | $10,370 | 60.32% |

| White | $108,155 | 5.78% | $45,707 | 13.68% | $32,797 | 19.07% | $44,993 | 13.90% | $15,047 | 41.57% |

Based on the summarized data, car insurance is affordable for ethnic groups with higher wages. Also, there’s a major disparity among ethnic groups. The highest-paid ethnic group under manager occupations are those who identify as Asian.

Regardless of ethnic group, cashiers have the lowest wages in Houston. When compared to the Houston average annual premium for car insurance, cashiers may have paid over 60 percent of their income for car insurance.

What about wage by gender in common jobs?

Let’s narrow the scope and see how wage and car insurance as a percent of income affect gender. Male motorists generally pay more for car insurance than female motorists, but do male motorists pay more as a percent of income? The data summary below will show the stats. Let’s examine it.

| Wage by Common Jobs Summary | Average Male Salary | Car Insurance as % of Income (Male) | Average Female Salary | Car Insurance as % of Income (Female) |

|---|---|---|---|---|

| Cashiers | $25,597 | 24.44% | $21,726 | 28.79% |

| Retail Salespersons | $49,696 | 12.59% | $34,125 | 18.33% |

| Drivers/Sales Workers and Truck Drivers | $50,111 | 12.48% | $32,436 | 19.28% |

| Elementary andMiddle School Teachers | $53,241 | 11.75% | $47,987 | 13.03% |

| Other Managers | $119,719 | 5.22% | $78,562 | 7.96% |

First, let’s address the wage disparity. Male wages are significantly higher than female wages. Male wages in retail sales are about $16,000 more than female wages in retail sales. In addition to wages, female retail salespeople pay more for car insurance as a percent of income. Males paid 12.59 percent while females paid 18.33 percent.

The trend is the same for all other occupations where males outearn their female counterparts, and females pay more for car insurance as a percent of income.

Poverty by Age and Gender

Poverty is a challenge that many Houston residents face. Data USA reported that 473,000 in Houston live below the poverty line, which is 21.2 percent of the population. But who’s affected by poverty more when it comes to gender?

Female residents between the ages of 25–34 are the most likely to live below the poverty line. An estimated 42,578 females in that age range are affected by poverty, the highest share of poverty in Houston.

Males between the ages of 6–11 have the highest share of poverty among males, according to Data USA.

Poverty by Race and Ethnicity

Which race and ethnic group is affected by poverty the most in Houston? According to Data USA, 36.1 percent of people living below the poverty line are Hispanic or Latinos, which is the largest share on record on Data USA. Roughly 34 percent of people who identify as white live below the poverty level, followed by 17.9 percent of black or African Americans.

Employment by Occupations

Data USA gives us some insight into the job growth between 2017 and 2018. They report that Houston’s job growth increased by about 4 percent. That’s an increase from 1.11 million jobs to 1.15 million jobs from 2017 to 2018. The most common jobs in Houston were sales, administrative support, construction, and management occupations.

What is driving in Houston like?

If you’re new to Houston, you may have to get adjusted to long wait times while you’re driving during the peak hours of the day.

Peak hours are 8 a.m. and 5 p.m.

This section of the guide will cover everything you need to know about driving in Houston. We’ll talk about the major roads, the type of vehicles you’ll see, the traffic forecast, what the weather is like, public transportation, parking, and air quality.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What are the major roads in Houston?

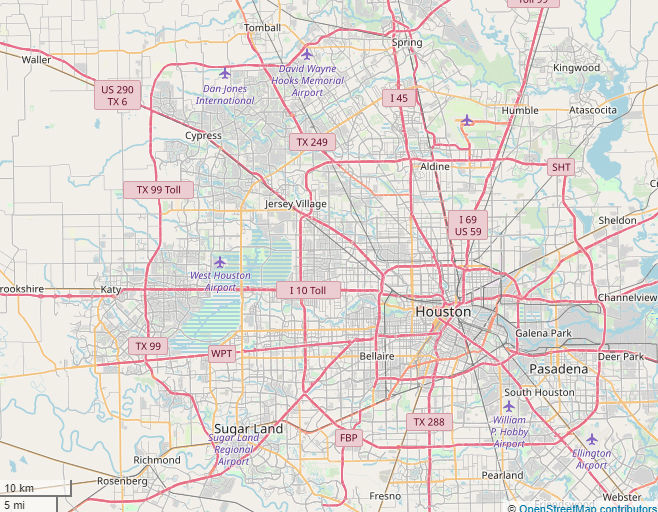

Before we get into details, let’s look at a map that shows the major roads, including interstates.

Houston is a major metropolitan area that’s covered in a network of highways, state highways, and city streets. There are seven airports in the Houston area.

Major Highways in Houston

There are 25 active routes in Texas that total up to 3,501 miles. Houston has 13 major highways. Four of those highways are state highways, and four are major U.S. highways and interstates.

The U.S. highways and interstates in Houston are I-45, I-69, US-59, and US-290. State highways in Houston are TX-6, TX-99, TX-249, and TX-288.

What about toll roads? Toll Road Guru lists over 15 toll roads in Houston. Houston is part of Harris County, so we’ll show the toll roads available in Harris County:

- Hardy Toll Road

- Hardy Airport Connector

- Sam Houston Ship Channel

- Sam Houston Tollway

- SH 242

- Tomball Tollway

- Katy Freeway Managed lanes I-10 QuickRide and US 290

Toll road fees depend on your vehicle. Houston motorists could pay as low as 50 cents and up to $8.75 for toll road fees.

Popular Road Trips/Sites

Houston is home to major sports teams, beaches, lakefronts, and a nightlife that rivals some of the biggest cities in the United States. But why take our word for it? Here’s a video from Expedia showing the popular road trip area and popular sites in Houston.

Houston is one of Texas’ most popular cities, so there are likely to be tourists there throughout the year. And thanks to major league sports like the Houston Astros, Houston Rockets, and Houston Texans, there is something to do there throughout the year.

Road Conditions in Houston

It may be a great place to visit, but how are the road conditions in Houston? Car insurance companies consider road conditions when issuing policies. Why?

Poor road conditions can make a commute risky. Motorists often get into accidents due to avoiding potholes, rough patches of asphalt, or other obstacles that make a commute dangerous.

The vehicle operating costs for motorists in the city is $610.

Vehicle operating costs (VOC) is the estimated cost of vehicle usage. This includes fuel, mileage-dependent depreciation, maintenance, tires, and repairs.

Before we explore the road condition percentages, let’s watch a short video on what poor road conditions cause.

In our introductory table, we listed the road conditions of Houston. Most of Houston’s roadways are in questionable condition. An estimated 38 percent of Houston roadways are in good condition. Eleven percent of roads in Houston are in fair condition, while the other 52 percent of roads are in poor or mediocre condition.

Does Houston use speeding or red-light cameras?

The state of Texas has an automated enforcement law that allows cities and counties in the state to use red-light cameras and speed cameras. For now, Texas only has red-light cameras in the state. In June 2019, Governor Greg Abbott signed a bill into law that bans all red-light cameras in Texas. But some cities in Texas still have them up.

Let’s watch a news report on why red-light cameras are still functioning in Texas even though they’re banned.

Does Houston have red-light cameras? It’s possible, but even if a motorist was caught on camera running a red light, they could just ignore the fine since the Department of Motor Vehicles (DMV) in Texas disregards red-light camera tickets.

Could the law change? Yes. As stated in the news report, law enforcement is actively looking for ways to enforce red-light camera laws before the automated enforcement contract ends in 2024.

What types of vehicles are in Houston?

You’re likely to see a variety of vehicles in Houston. The most popular vehicles in the city are Toyotas, Nissans, Fords, and Chevrolets. Sedans and compact SUVs are the most fuel-efficient vehicles, while trucks and SUVs are more powerful vehicles. For this section, we’ll explore some vehicle information regarding Houston.

Most Popular Vehicles Owned

The Houston Chronicle reported that the Ford F-150 was the best-selling vehicle in Houston in 2018. When you do a Google search of the most popular vehicles in Houston, you’ll find that trucks and compact SUVs are the most popular vehicles in the city.

Trucks are less likely to be in vehicle accidents. Later in the guide, we’ll show you details on why motorists who drive trucks are less likely to get into an accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How many cars per household?

Data USA reported that 461,000 households in Houston own two vehicles, which is 41 percent of households in the city. The next largest share is households that own one car, which is about 30 percent (336,000 households).

Less than 3 percent of households in Houston own five or more vehicles. The national average of households that own two vehicles is 40.3 percent. Houston’s percentage isn’t very far from the national average, but it’s higher.

Households Without a Car

What about households that don’t own a vehicle? The national average percentage for households that don’t own a vehicle is 4.26 percent. Houston’s average percentage for households that don’t own a vehicle is 3.87 percent (43,500 households). Those without a motor vehicle will have to rely on Houston’s public transit and railway system, which we’ll talk more about later in the guide.

Speed Traps in Houston

Speed traps are traffic enforcement stings where law enforcement waits in a designated area and monitors the speed of motorists who pass. The cause of speed traps comes from complaints from people who live in the area or people who do business in the area.

Speedtrap.org lists Houston as the city with the most speed traps in Texas. The latest speed trap was reported in October 2019.

If you’re caught in a speed trap, you’ll likely have to pay a speeding ticket. It will affect your driving record and possibly your car insurance rate.

Did you know Android and Apple iOS have speed-trap tracking on their GPS? Turn on your GPS on your smartphone and your phone will alert you.

Vehicle Theft in Houston

Each year, the FBI releases an annual report that shows the total number of crimes of states and the total number of crimes in each state’s city. Texas’ total number of motor vehicle thefts in 2018 was 56,984. The number of vehicle thefts in Houston was 11,949 in 2018.

Vehicle thefts can occur anywhere, but vehicle theft is less likely to happen in safer areas around Houston. Neighborhood Scout lists these 10 locations as the safest neighborhoods in Houston.

- Dogwood Acres / Walden Woods

- Westheimer Parkway / South Ferry Road

- Kingsland Boulevard / Baker Road

- Addicks

- Echo Mountain Drive / Mills Branch Drive

- Telge Road / Northwest Freeway

- Kingwood Drive / Forest Garden Drive

- River Forest Drive / Dairy Ashford Street

- Kingwood Drive / Willow Terrace Drive

- Dorado Boulevard / Clear Lake City Boulevard

Neighborhood Scout grades the safety of the city by researching and reporting the crime summary through crime rate per 1,000 residents, crime index, and the chances of becoming a victim of a crime.

The crime index is Neighborhood Scout’s way of measuring the overall safety of a city. They use a 100-point scale, where 100 is considered the safest rating and 1 is considered the most dangerous. Houston’s crime index on Neighborhood Scout’s website is four.

But let’s continue to other data to see the rate in which crime happens in Houston. We’ve summarized Neighborhood Scout’s analysis of the city. Here’s what we found.

| Crime Summary | Violent Crimes | Property Crimes | Total Crimes |

|---|---|---|---|

| Number of Crimes | 24,330 | 95,926 | 120,256 |

| Crime Rate (per 1,000 residents) | 10.46 | 41.25 | 51.71 |

Houston had over 24,000 violent crimes and nearly 100,000 property crimes in 2019. Houston residents were likely to encounter property crimes than violent crimes based on the crime rate per 1,000 residents.

What are the chances that a person becomes a victim of crime in Houston? Neighborhood Scout separates the crime to give readers an idea of which one is more likely. Based on the crime summary data above, we know the crime per 1,000 residents, but let’s look at the crime rate from another perspective.

| Area Crime Summary | Violent Crime Rate | Chances of Becoming a Victim (Violent Crime) | Property Crime Rate | Chances of Becoming a Victim (Property Crime) |

|---|---|---|---|---|

| Houston, Texas | 10.46 | 1 in 96 | 41.25 | 1 in 24 |

| Texas (state average) | 4.11 | 1 in 243 | 23.67 | 1 in 42 |

| National average | 4 | - | 24 | - |

In addition to the crime rate, we’ve added Neighborhood Scout’s chances of becoming a victim summary. One in 96 people may encounter a violent crime, while one in 24 may encounter a property crime in Houston. Compared to the state average, Houston appears to be a city where residents encounter crime more than other cities.

It’s not because Houston is a bad city. Due to the city’s population size, the rate of crime is likely to happen more so than in a smaller town in Texas.

How is traffic in Houston?

With over 2 million people taking residency in the city, Houston can get quite congested throughout the week and during a major event. As an insured motorist living in Houston, you’ll have your share of long wait times while driving on the roadway.

This section will explore the traffic forecast of Houston, the common methods of transportation, the busiest highways in the city, crash fatality statistics from the National Highway Traffic Safety Administration (NHTSA), and other aspects that will help you as a resident and motorist in Houston.

Traffic Congestion

Anyone can see the traffic forecast now that technology has connected our phones to cellular networks and other mobile networks around the country. Three agencies — Inrix, TomTom, and Numbeo — produce reports that show the traffic forecast of a particular city once you search for it on their website.

Inrix shows the city’s ranking among traffic congestion, TomTom provides a live feed of traffic conditions, and Numbeo allows contributors to report traffic conditions in the city in which they live.

We’ve summarized each agency’s report and placed them in the data tables below.

| Inrix Traffic Summary | Inrix Traffic Stats |

|---|---|

| Hours Spent in Congestion | 98 hours in a year |

| 2018 Impact Rank | Rank 77 |

| Inner City Travel Time | 4 minutes |

| Cost of Congestion (per Driver) | $1,365 |

Inrix reported that motorists in Houston spent a total of 98 hours in traffic in 2018. That’s not in one day but the time spent in traffic over time. Traveling in the inner city, excluding peak hours, was fairly short for urban residents and visitors who needed to get to their destination.

Houston ranked 77th in most congested cities in the world, according to Inrix.

What about TomTom’s projections of Houston? Let’s take a look at their 2019 summary of Houston.

| TomTom Traffic Summary | TomTom Traffic Stats |

|---|---|

| Congestion Level | 24% |

| Extra Travel Time during A.M. Rush | 13 minutes per 30-minute trip |

| Extra Travel Time during P.M. Rush | 18 minutes per 30-minute trip |

| Time Lost in Rush Hour per Year | 119 hours or four days, 23 hours |

| Morning Rush | 43% |

| Evening Rush | 60% |

| Highways | 23% |

| Non-highways | 25% |

The average congestion level in Houston was 24 percent, which means that when traffic was congested, commuters took 24 percent longer to arrive at their destination. TomTom reported that motorists in Houston waited 119 hours in traffic in 2019 (4 days, 23 hours total).

Finally, Numbeo results show the traffic index, time index, and inefficiency index.

| Numbeo Traffic Summary | Numbeo Traffic Stats |

|---|---|

| Traffic Index | 202.57 |

| Time Index (in minutes) | 41.22 |

| Inefficiency Index | 240.52 |

What do traffic index, time index, and inefficiency index mean?

Traffic index is the composite time consumed in traffic due to work commute, time spent in traffic, estimated carbon dioxide consumption while in traffic, and overall errors in traffic.

The time index is the average time for one-way transport, while the inefficiency index is an estimate of errors in traffic.

The traffic index in Houston is roughly 203, the time index is 41 minutes, and the inefficiency index is approximately 241.

Transportation

Speaking of traffic, the average commute time in Houston is 26.7 minutes. The national average commute time is 25.7 minutes.

Data USA reports that roughly 2 percent of Houston’s workforce has super commutes (commutes that take longer than 90 minutes). Average commute times can take longer if there’s traffic congestion or inclement weather.

Busiest Highways

The top three busiest highways in Houston are the West Loop Freeway, Southwest Freeway, I-610, I-69, US-59, and Eastex Freeway, as reported by the Texas A&M Transportation Institute. Annual congestion costs from these three highways alone are in the hundreds of millions.

These highways are at least 10 lanes. I-610 is a loop highway, which is often used to get to another highway as quickly as possible.

How safe are Houston streets and roads?

Safety can be subjective. Some people in Houston will say their city is safe, and they wouldn’t be wrong. Safety is randomly compromised, and the next accident can come when a motorist doesn’t expect it. Some accidents have fatal outcomes.

The NHTSA provides a series of annual reports that list the number of fatalities in comprehensive data tables. We’ve summarized their research in the number of crash fatalities that occurred in Harris County in 2018.

| Type of Crash Fatality | Number of Fatalities |

|---|---|

| Fatalities (All Crashes) | 1,109 (NHTSA's Total: 456) |

| Single-Vehicle Crash | 242 |

| Involving an Alcohol-Impaired Driver | 202 |

| Involving a Roadway Departure | 173 |

| Passenger Car Occupant | 149 |

| Involving an Intersection | 115 |

| Pedestrian | 109 |

| Involving Speeding | 105 |

| Pedal Cyclist | 14 |

These crash totals are from Harris County’s 2017 report. The highest number of crash fatalities involved a single-vehicle crash, while the lowest number of fatalities involved pedal cyclists (any person using a device or vehicle requires them to pedal for transport).

What type of roads were accidents likely to happen? We can use the Fatality Analysis Reporting System (FARS) to determine what type of road most crash fatalities occurred on.

| Fatal Crashes by Area and Road Function | Harris County | Texas |

|---|---|---|

| Rural | 7 | 188 |

| Urban | 72 | 438 |

| Freeway and Expressway | 51 | 243 |

| Other | 93 | 1,001 |

| Minor Arterial | 76 | 624 |

| Collector Arterial | 36 | 581 |

| Local | 31 | 225 |

| Unknown | 0 | 5 |

| Total Fatal Crashes | 366 | 3,305 |

Before we talk about the data, let’s examine what some of the terms mean. Arterial roads deal with heavy traffic and are classified as highways or city roadways (minor arterial). Collector arterial roads collect traffic and ultimately deliver motorists to arterial roads.

Since Houston is mostly composed of urban areas, the likelihood of rural crash fatalities is minimized. Roads classified as local, other, and unknown could be residential streets or unclassified streets. Roads marked as Other had the most crash fatalities in the data.

Do Harris County railways have just as many fatal crash incidents? The information contained in the final table of this section is from the U.S. Department of Transportation (USDOT). We’ll explore Harris County’s railway incidents in 2016 based on our latest research.

| Highway User Speed | Highway | Highway User Type | Rail Equipment Type | Non-Suicide Fatality | Non-Suicide Injury |

|---|---|---|---|---|---|

| 10 | 5800 Long Road | Automobile | Freight Train | 0 | 1 |

| 0 | Fondren Road | Automobile | Freight Train | 0 | 0 |

| 3 | In the Yard | Pick-up truck | Light Locomotive | 0 | 0 |

| 5 | Jacinto Boulevad Crossing | Truck-trailer | Railway Cars | 0 | 0 |

| 0 | Kempwood Drive | Pick-up truck | Freight Train | 0 | 0 |

| 0 | Long Drive | Truck-trailer | Freight Train | 0 | 0 |

| 10 | Long Drive | Automobile | Freight Train | 0 | 0 |

| 0 | Long Street | Truck-trailer | Freight Train | 0 | 0 |

| 0 | Lyons Avenue | Pedestrian | Freight Train | 0 | 0 |

| 20 | Lyons Avenue | Automobile | Freight Train | 0 | 1 |

| 10 | Lyons Avenue | Pick-up truck | Freight Train | 0 | 0 |

| 0 | Oil Tanking East | Truck-trailer | Freight Train | 0 | 0 |

| 5 | Oil Tanking West | Automobile | Freight Train | 0 | 0 |

| 19 | Parker Street | Automobile | Freight Train | 0 | 0 |

There were no fatalities involving railways in the USDOT latest report. As uncommon as railway accidents are, be vigilant when approaching a railway while operating a motor vehicle.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What is Allstate America’s best drivers report?

Allstate not only reports their insurance premiums and financial performance, but they also gather information on the city with the best drivers. Each year, Allstate releases an annual report known as the Best Drivers in America Report. The report ranks Houston 158th in the list of cities, which is an increase in rank from the 2018 report.

Houston motorists, according to the Best Drivers in America Report, have collisions every 7.66 years. We usually report the Drivewise® Hardbraking Events per 1,000 miles, but that information wasn’t available.

Ridesharing

Ridesharing is available everywhere in the country these days. Houston has several ridesharing services available for commuters. Here’s a list of ridesharing services in Houston:

- Arro

- Blacklane

- Carmel

- Jayride

- Limos.com

- Lyft

- SuperShuttle

- Talixo

- Taxi

- Uber

The cost of ridesharing varies. Uber has a minimum fare of about $6, while Lyft has a minimum fare of about $4. To get a more accurate estimate, download a ridesharing app and set your starting point and destination.

E-star Repair Shops

Esurance has a program where policyholders can check the status of car repairs called the E-star® Direct Repair. This program works when a policyholder files a car insurance claim and pursues the next step in finding an auto repair shop.

Not all auto repair shops comply with the E-star® Direct Repair, but Esurance lists a few locations within a 20-mile radius that do.

| Name of E-Star Repair Facility | Address | Contact Information |

|---|---|---|

| Carstar Premier | 9520 Richmond Ave. Houston, TX 77063 | email: [email protected] P: (713) 952-3777 |

| Charlton's Body Repair Cf | 1131 Staffordshire Rd. Stafford, TX 77477 | email: [email protected] P: (281) 499-1126 F: (281) 499-1694 |

| Greenfield Collision Center | 15920 Kuykendahl Houston, TX 77068 | email: [email protected] P: (281) 580-1994 F: (281) 580-3205 |

| Miller Auto & Body Repair | 4816 N. Shepherd Houston, TX 77018 | email: [email protected] P: (713) 864-7820 F: (713) 864-6280 |

| Russell & Smith Ford Honda | 1109 South Loop W Houston, TX 77054 | email: [email protected] P: (713) 663-4216 F: (713) 663-4110 |

| Service King Galleria | 5919 Westheimer Rd. Houston, TX 77057 | email: [email protected] P: (713) 243-1400 F: (713) 266-4316 |

| Service King Humble | 450 E. FM 1960 Humble, TX 77338 | email: [email protected] P: (281) 446-6660 F: (800) 214-2373 |

| Service King Pearland | 2330 Smith Ranch Rd. Pearland, TX 77584 | email: [email protected] P: (713) 795-3100 F: (800) 214-2373 |

| Service King Southwest Freeway | 10475 Southwest Freeway Houston, TX 77074 | email: [email protected] P: (713) 773-5000 F: (713) 772-1746 |

| Sunrise Paint & Body Inc. | 4211 Cook Rd Houston, TX 77072 | email: [email protected] P: (281) 933-7473 F: (281) 933-9426 |

After you select the auto repair shop, your car repairs will be done at the selected location. You can check the status of repairs using the Esurance Mobile App or through your online Esurance account.

What is the weather like in Houston?

Texas has relatively mild temperatures throughout the year until summer comes. Houston also follows this trend. Being close to water and wetlands, Houston is one of the warmest cities in the state, and it battles a lot of rainfall and flooding during the hurricane season. Here’s a summary of average temperatures and precipitation.

| Houston Weather Averages | Details |

|---|---|

| Annual High Temperature | 78.3° |

| Annual Low Temperature | 59.8° |

| Average Temperature | 69.1° |

| Average Annual Precipitation – Rainfall | 45.28 inch |

| Days per Year With Precipitation – Rainfall | 106 days |

| Annual Hours of Sunshine | 2,633 hours |

| Average Annual Snowfall | N/A |

The average high temperature is around 78 degrees, but the average temperatures in the summer far exceed that. Heat indexes can reach up to the 100s in Houston. The city can encounter a polar vortex, but it’s normally not as bad as other states that are located in the Southeast or Midwest.

Houston has seen its share of natural disasters. In 2017, 29 natural disasters were recorded in Houston. The national average for natural disasters in 2017 was 13.

Is public transit available in Houston?

Houston’s transit system is known as METRO. It’s a public bus transit and rail system where thousands of commuters use METRO transit and parking services. Here are the fares for METRO.

| Route Type | Fares | Discounted Fares Students, Seniors, Medicare Cardholders, and Disabled |

|---|---|---|

| Local Bus / METRORail | $1.25 per ride | $0.60 per ride |

| Park & Ride Zone 1 | $2.00 per ride | $1.00 per ride |

| Park & Ride Zone 2 | $3.25 per ride | $1.60 per ride |

| Park & Ride Zone 3 | $3.75 per ride | $1.85 per ride |

| Park & Ride Zone 4 | $4.50 per ride | $2.25 per ride |

Commuters in the city are allowed to use cash, or they can receive a METRO Q® Fare Card or METRO Day Pass at any METRO retailer. Students, seniors, and disabled commuters can receive a 50 percent discount on all METRO bus and light-rail services.

To receive discounts on METRO transits, you must show proof that you are a student, senior, or a person with disabilities.

Residents, commuters, and visitors can use direct nonstop service in downtown Houston, the Texas Medical Center, and other major employment centers. METRO has Park & Ride lots, which serve as a staging area for vanpools and carpools.

METRO commuters who take the bus daily may park in the Park & Ride lots. However, if you park in a Park & Ride lot for three consecutive days for purposes other than bus transit, you must contact the METRO Police Department to request to park in the Park & Ride lots.

If you fail to do so, your car may be towed. To contact the METRO Police Department, call #673 (#MPD) by phone or email them at [email protected].

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there any alternatives to transportation in Houston?

BCycle has made its way to the city of Houston, with 90 stations and 635 bikes available for rental around downtown Houston. The rentals are short-term, lasting for about 30 minutes to an hour.

The bike-share program allows unsubscribed users to rent a bike for $3 per 30 minutes from any BCycle kiosk. Memberships are only available through the mobile app. Members have access to unlimited 60-minute trips.

Memberships cost $13 per month or $79 per year. A member of the BCycle can undock one bike at a time for free up to one hour but will have to pay a $3 usage fee for each additional 30 minutes.

Individuals who want to use BCycle can sign up through the BCycle® Mobile App. The mobile app provides a station map on the go. All guest users will pay a flat rate of $3 per 30 minutes.

Guests have to pay by credit or debit card at the station kiosk to unlock a bike. For each additional 30 minutes, your credit or debit card will be charged a $3 usage fee.

Is parking easy in Houston?

The cost of parking in Houston, however, varies upon location. Houston’s parking services are easily managed by the city’s mobile app, called ParkHouston. There are three methods of payment:

- Pay-by-Plate – Enter your license plate number to pay. If you do pay by license plate, there’s no need to display the receipt on your dashboard.

- Pay-by-App – Download ParkHouston App, which is powered by ParkMobile.

- Pay-and-Display – Pay the meter. You’ll have to display your receipt on your dashboard.

How is the air quality in Houston?

The Environmental Protection Agency (EPA) is a government agency that has annual environmental projections on different cities across the United States. This is important due to the emission standards of each state.

These standards are important because the EPA reviews the quality of the air in a particular area. If air quality becomes gradually worse, the EPA may strongly suggest legislation on emission laws, which could affect how motorists use transportation.

The EPA determines the air quality of an area through the air quality index.

The air quality index (AQI) is the measurement of how clean the air is in a metropolitan area.

Houston is part of the Houston-The Woodlands-Sugar Land, Texas metro area. The data below shows the AQI of the area in a three-year trend.

| Year | Days with AQI | "Good" Days | "Moderate" Days | "Unhealthy for Sensitive Groups" Days | "Unhealthy" Days | "Very Unhealthy" Days |

|---|---|---|---|---|---|---|

| 2017 | 365 | 184 | 156 | 22 | 3 | 0 |

| 2018 | 365 | 166 | 164 | 26 | 7 | 2 |

| 2019 | 305 | 144 | 131 | 25 | 4 | 1 |

Days with good AQI have gradually decreased, while the days with unhealthy AQI fluctuated. The population size and the daily use of vehicles are more than likely the cause. Urban areas tend to have unstable AQIs. Although the unhealthy AQI has fluctuated, there were more days with moderate to good AQI.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Are there discounts for active military personnel and military veterans?

Veterans, active or retired, can receive military discounts from car insurance companies. To clarify, some car insurance companies may not have a military discount available, but it could change in the future.

USAA is one of the car insurance companies known for their lower-than-average premium policies for military members and their immediate families. In this section, we’ll explore the number of veterans in Houston, military bases close to Houston, discounts for veterans, and USAA’s availability in Houston.

According to Data USA, 49,714 veterans live in Houston. The largest share of veterans — 20,610 — served in the Vietnam Conflict. The second-largest share served in the second Gulf War (2001–).

Several locations in Houston are involved with the National Guard, but none of them are military bases. The closest military base to Houston is Fort Sam Houston Army Base, which is nearly three hours away from Houston.

What about car insurance discounts? We named several companies in the guide that offer car insurance to residents in Houston. However, some of the companies don’t offer military discounts.

The companies that offer military discounts are Allstate, Geico, and USAA. State Farm offers military discounts for select states, so ask a State Farm agent if they offer military discounts in Houston.

We’ve seen how car insurance can be for USAA. Let’s get another look at the average annual premium of a USAA policy.

| Company | Company Average Annual Premiums |

|---|---|

| Allstate | $6,515 |

| American Family | $6,847 |

| Geico | $3,969 |

| Nationwide | $4,410 |

| Progressive | $5,257 |

| State Farm | $3,466 |

| USAA | $2,932 |

USAA has the lowest available premium. Imagine what other discounts will do to the overall premium. A policyholder could save a good deal of money.

Interested in some unique city laws?

There are a few laws that are unique to Houston. Some of them are interesting while others are laughable. This section will talk about laws that are specifically designed by Houston lawmakers.

We normally cover unique distracted driving laws, but the city of Houston complies with Texas state law, which says motorists are not allowed to text or read while operating a motor vehicle. If a person needs to use the phone, they can’t hold the device while it’s in use. Teens are not allowed to use phones or any other device at all.

What about food truck laws in Houston?

There are different requirements for food truck vendors. Here’s a video explaining how food truck regulations work in Harris County, the county where Houston is located.

In addition to needing a business license, food truck vendors must get their certification through Houston’s Health Department food safety classes. Houston’s government website has more information on how they classify food trucks.

Are tiny homes legal in Houston? Yes. Before we talk about tiny home laws in Houston, let’s watch a short news report about a couple living in a tiny home in Houston.

The residential code or city code for tiny homes in Houston is that the distance to property lines must be at least three feet. Stairs must have handrails or guards and the bedroom must be open (no doors, open space).

A solid foundation must be set. Parking must include at least three spaces for two homes. Tiny homes in Houston must come with working mechanical, electrical, and plumbing systems.

Parking laws in Houston are just as elaborate as any other city in the United States. Violating parking laws can get you a ticket. Here is a list of violations and fines a motorist can pay if parking laws are violated.

| Code | Violation | Current Fine | After 30 Days |

|---|---|---|---|

| APK-1 | Parking meter expired | $30 | $55 |

| APK-2 | Overtime parking | $30 | $55 |

| APK-5 | Parked on street more than 24 hours | $30 | $55 |

| APK-7 | Parked in bus zone | $50 | $75 |

| APK-8 | Parked in reserved zone | $45 | $75 |

| APK-9 | Parked in a fire lane | $305 | $355 |

| APK-10 | Parked in emergency no parking zone | $60 | $80 |

| APK-11 | Parked blocking private driveway | $40 | $65 |

| APK-12 | Parked within 15 feet of fire hydrant | $105 | $155 |

| APK-13 | Blocking or parking on sidewalk | $40 | $65 |

| APK-14 | Parked within 20 feet of a crosswalk-intersection | $40 | $65 |

| APK-15 | Parked within 50 feet of rail crossing | $40 | $65 |

| APK-16 | Parked in a tow away zone | $70 | $105 |

| APK-17 | No parking anytime | $40 | $65 |

| APK-18 | Parked in a school zone | $55 | $80 |

| APK-19 | Other parking violation | $40 | $65 |

| APK-20 | Parked more than 18” from right-hand curb | $40 | $65 |

| APK-21 | Parked in a handicapped zone | $500 | $600 |

| APK-22 | Commercial vehicle parked between 2 a.m. and 6 a.m. | $60 | $80 |

| APK-23 | Parking a large vehicle in residential district | $60 | $80 |

| APK-24 | Parked in fire zone | $130 | $180 |

| APK-25 | Other fire code parking violation | $305 | $355 |

| APK-26 | Trailer/semi-trailer parked on street over 2 hours | $60 | $80 |

| APK-27 | Parked on park lawn where prohibited by sign | $60 | $80 |

| APK-28 | Parked obstructing street | $40 | $65 |

| APK-29 | Double parked | $40 | $65 |

| APK-36 | Parking non-commercial vehicles in CVLZ during posted hours of operation | $255 | $355 |

| APK-38 | Parking in a CVLZ without either displaying current/valid CV permit or paying metered fee | $305 | $405 |

| APK-39 | Parked in CVLZ in excess of the maximum time | $305 | $405 |

Violating parking laws can cost a motorist up to $405. For more specifics and photo examples on parking laws in Houston, check out their publication on parking laws.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Frequently Asked Questions

What factors should I consider when looking for cheap auto insurance in Houston, Texas?

When searching for affordable auto insurance in Houston, Texas, consider the following factors:

- Coverage options: Evaluate the types of coverage available and choose the ones that meet your needs without unnecessary extras.

- Deductibles: Opting for a higher deductible can lower your premiums but will require you to pay more out of pocket in the event of a claim.

- Discounts: Inquire about available discounts such as safe driver discounts, multi-policy discounts, or discounts for certain safety features in your vehicle.

- Customer service: Research the reputation of insurance providers for their customer service and claims handling.

How can I find cheap auto insurance quotes in Houston, Texas?

Here are some ways to find affordable auto insurance quotes in Houston, Texas:

- Shop around: Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Online comparison tools: Use online platforms that allow you to compare insurance quotes from various companies easily.

- Consider local insurers: Some local insurance companies may offer competitive rates specific to the Houston area.

- Review and update your policy regularly: As your circumstances change, make sure to update your policy to reflect any qualifying factors for discounts or changes in coverage needs.

Are there any disadvantages to buying cheap auto insurance in Houston, Texas?

Yes, there can be drawbacks to purchasing cheap auto insurance, including:

- Limited coverage: Cheaper policies may offer less coverage or have higher deductibles, meaning you might have to pay more out of pocket for repairs or medical expenses.

- Unreliable customer service: Some budget insurers may provide subpar customer service, leading to frustrating experiences when filing claims or seeking assistance.

- Higher risk: Insurers offering cheap rates may focus on insuring higher-risk drivers, which could result in a higher likelihood of claims and potentially increased premiums in the future.

What are the advantages of buying cheap auto insurance in Houston, Texas?

There are a few advantages to purchasing cheap auto insurance:

- Cost savings: Cheap auto insurance can help you save money on premiums, leaving more funds available for other expenses.

- Basic coverage needs: If you have a low-value vehicle or no outstanding loans, you may only require basic coverage, making a cheap policy suitable.

- Budget-friendly option: For individuals on a tight budget, cheap auto insurance allows for compliance with state minimum requirements while minimizing costs.

Are there any specific requirements or minimum coverage limits for auto insurance in Houston, Texas?

Yes, auto insurance in Houston, Texas is subject to specific requirements and minimum coverage limits. The state of Texas mandates that drivers carry liability insurance to cover potential damages or injuries caused to others in an accident. The minimum coverage limits in Texas are commonly referred to as 30/60/25, which means:

- $30,000 for bodily injury liability per person

- $60,000 for bodily injury liability per accident

- $25,000 for property damage liability per accident

It’s important to note that these are the minimum requirements, and it may be advisable to consider higher coverage limits to provide better protection in case of a severe accident.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.